New Report Shows Farm Subsidies Recieved by Congress Members

Cut Spending – But Not My Farm Subsidies! (by Chris Campbell, Amber Hanna and Don Carr, Environmental Working Group)

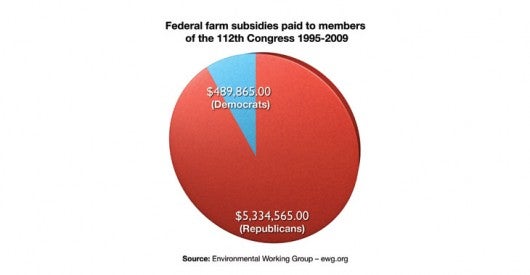

EXCERPT: We don’t have a firm count of how many farmers are serving in the current Congress, but we do know, based on a recent analysis of the Environmental Working Group’s Farm Subsidy Database, that 23 of them, or their family members, signed up for taxpayer-funded farm subsidy payments between 1995 and 2009. This would be a good place to point out that just five crops – corn, cotton, rice wheat and soybeans – account for 90 percent of all farm subsidies. Sixty-two percent of American farmers do not receive any direct payments from the federal farm subsidy system, and that group includes most livestock producers and fruit and vegetable growers. Read the full article here…

Your Privacy Choices

Your Privacy Choices

This pie graph appears a little biased. Could it be that most Democrats come from urban districts that have little in the way if agriculture? Perhaps if they had a subsidy for urban growing of pot or coke plants the percentage would increase. Just a thought.

Tom,

Certainly a valid point. beginningfarmers.org is nonpartisan. I posted the graph not to demonize one political party, but because I thought it was interesting that 23 members of Congress got $6 Million in farm subsidies over a 4 year period, which seems like an incentive not to change the current system in which 62% of farmers receive no subsidies at all.

Tom is the typical partisan republican neocon, has no real idea of the actual facts, but feels qualified to deny them.

By the way, “coke” plants won;t grow in the US, wrong climate, but it is a good example of the childish partisan arguments coming from the right, it’s as if they’re trying to outdo the left in stupidity anymore.

Over 90% of farm subsidies go to republicans, period. And then we can discuss the new layer of welfare for farmers whose land borders urban and subburban areas, letting residential property own pay for all sorts of infrastructure improvements at no cost to the ag land owner, making the ag land quadruple in price for development purposes while not paying for the improvements they benefitted from. And then simply sell the land to a developer at an obscebe profit and never have to pay the higher tax rate on the land, and then the developer turns around and gets a tax break under the banner of “economic development.

Senator Jerry Behn, Iowa republican, get’s over $50,000 on average in farm welfare while runing on an anti-welfare, anti-spending camapign, and is offering a tract of land as a residential development, with utilities ran etc, but plants hay on it to keep from having to pay residiential property tax rates on the land, which of course is actually higher than his ag rates.